Qualified Charitable Distributions: What nonprofits need to know about these tax-savvy gifts

Over the last few years, the number of Qualified Charitable Distributions (QCDs), also known as IRA Charitable Rollovers, that nonprofits receive annually has nearly tripled. More and more older donors are giving these gifts from their IRAs for two key reasons. First, they reduce donors' taxable income, and, second, they allow them to meet their Required Minimum Distributions (required annual withdrawals for IRA-owners). Plus, your nonprofit can benefit from these gifts because they’re often much bigger than cash gifts, and QCD donors tend to become recurring givers, using them to meet their RMDs each year.

Take advantage of the fastest growing area of philanthropy by learning about the benefits of these tax-savvy gifts and how you market them to your donors.

- Who can make a QCD?

- Why QCDs are so good for donors

- The benefits of QCDs for nonprofits

- 3 strategies to get more QCDs

Who can make a Qualified Charitable Distribution?

In order to make a gift from an IRA, a donor:

- Must be 70.5 or older

- Give from a traditional IRA (401Ks are not eligible, but like 401Ks, these are accounts that allow people to contribute pre-tax dollars where the money is then put into investments)

- Cannot give more than $100,000 as a tax-free QCD per year

Additionally, donors can use QCDs to meet their Required Minimum Distributions (RMDs) for the year. This is the amount of money that all IRA owners 72 and older must withdraw from their account each year. If they don’t withdraw this amount, they’ll receive a tax penalty of 50% of the amount of their RMD.

Why QCDs are so good for donors

Many of your older donors aren’t aware of the benefits of giving QCDs over cash, or even what they are. That’s why nonprofits who marketed QCDs just twice last year were 1.4 times more likely to get these gifts than those who didn’t market them at all. Increasing donor awareness is the first step in driving more of these gifts to your organization.

Make sure to mention these key benefits when having conversations with older donors, or in your marketing outreach:

QCDs lower taxable income.

When traditional IRA holders give QCDs instead of cash, those gifts don’t count as itemized deductions. Instead, they get deducted from their overall taxable income. The reason this is so important for donors is that most of them don’t itemize deductions anymore.

The Tax Cuts and Jobs Act of 2017 (TCJA) nearly doubled the previous standard deduction for 2018 through 2025. It went from $7,900 for an individual over 65 in 2017 to $13,600 in 2018. This caused the number of people itemizing deductions to fall from 30% to 10% after 2018 because most now see a bigger tax break from their standard deduction. That means that QCDs are the only way for most older donors to see a meaningful tax benefit from their gifts.

In the above example, if the couple makes charitable contributions using QCDs instead of cash, they will save $2,200 in taxes while still having the same donor impact.

QCDs help donors meet Required Minimum Distributions every year.

Since RMDs are taxable income, this required withdrawal may place donors into a higher tax bracket. And, as stated before, they face a 50% tax penalty on the amount of their RMD if they don’t withdraw. This is why many QCD donors become recurring givers — they can meet their RMDs, while saving on their taxes each year.

As an added bonus, donors can also reduce future RMDs by lowering their IRA account balance through giving QCDs.

The benefits of Qualified Charitable Distributions for nonprofits

If your organization is new to QCDs, you need to understand why these gifts are so important for fundraising growth.

QCD donors tend to become recurring givers.

In our 2021 QCD Report, nonprofits reported that more than 53% of QCDs came from previous QCD donors in 2020. This is usually because donors can use QCDs to meet their Required Minimum Distributions year after year. When a donor doesn’t need the extra cash from their IRA, then these gifts are the most tax-savvy way for them to give. They won’t raise their taxable income, but they’ll still meet their required withdrawals.

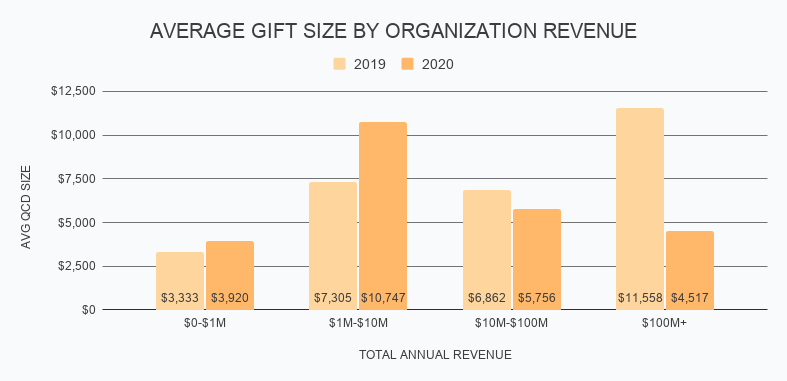

QCD gifts are generally larger than cash gifts.

When people feel wealthy, they act charitably and give more. This is called the generosity effect. And asking for gifts from an IRA reminds donors of their wealth. That’s why QCDs are often major gifts. In our report analysis, we found that the average gift size of a QCD in 2020 was $7,604. For context, most nonprofits count gifts over $5,000 as a major gift.

There’s a lot of money in IRAs and donors who can give from them.

People over 65 hold more than $5 trillion in their IRA accounts. Plus, 10,000 Baby Boomers turn 70.5 every day (the age they can start giving QCDs), making them one of the fastest growing age groups in America. That means there’s a huge group of people with a lot of money who are looking for tax-savvy ways to give. If you don’t take advantage of these gifts now, you’ll miss out on an incredible fundraising opportunity for your organization.

Next steps: 3 strategies to get more QCDs

1. Identify prospects who could give from their IRAs.

The most effective way to market QCDs is to send the right donors the right information at the right time. But to do this, you first need to know who your QCD-eligible donors are. If you don’t already have age data in your supporter database, try to survey your supporters. You can ask: “Are you over 70.5, have a traditional IRA, and are interested in tax-savvy ways to give?” Or, if asking age feels insensitive, you can simply ask: “Do you have a traditional IRA and are interested in tax-savvy ways to give?”

Anyone that answers ‘yes’ to these survey questions should be added to a prospect list for your organization to start sending QCD outreach to.

Additionally, you’ll want to get all your fundraising teams involved. While IRA gifts are usually handled by major giving teams, each department can work together to make sure you don’t miss any potential donors. For example, if a planned giving officer knows a donor who is 72, has an IRA, and has already made a bequest commitment in their will, they could refer this person to the gift officer in charge of QCDs or add them to a QCD prospect list.

You should also train gift officers to ask donors if they want to make their gift through “cash, IRA, or stock.” This can peak a donor’s curiosity, especially if they’re not aware of IRA gifts already.

2. Create a QCD page on your website.

In our QCD report analysis, we found that 52% of QCDs originate directly from a nonprofit’s website versus a link in an email. If you don’t have a page on your website with information on how to make IRA gifts to your organization, you may lose these potential donors.

On this page, you’ll want to include:

- Easy-to-understand information about what QCDs and RMDs are

- An outline of the tax benefits for giving QCDs vs cash

- Step-by-step instructions for making a QCD

- FAQs about recent legislation or more complex aspects of QCDs (you can find this information in our 2021 QCD Report)

The Animal Humane Society website has a great example of a QCD page. They answer common donor questions and explain the tax benefits in simple, easy-to-understand language.

Additionally, include a form on your QCD page that collects a donor's contact information, gift size, and what IRA custodian they’re using. This will help you track gifts and acknowledge your donors even when custodians send checks without donor information attached.

After a donor completes the form, send them an email, PDF, or to another page with the right forms for the custodian they selected as well as instructions for filling out the forms and mailing them in. If you don’t receive the gift, having your donor’s information will allow you to follow up with them to see if they need help completing their forms.

3. Educate donors on the benefits of giving QCDs over cash.

The three biggest challenges nonprofits face with marketing QCDs are identifying the right prospects, getting fundraising appeals into packed calendars, and educating donors properly.

If you’re unable to identify the right prospects, you can solve all of these challenges at once by including QCDs in your general fundraising appeals. You could do this by listing them as one of several ways to give for those over 70, or as a postscript in a broad fundraising email, like in this example from Second Harvest:

You’ll also want to include a link to the web page you created in step two. This could double as a way to continue collecting age data on your donors. If possible, make a note of anyone who clicks on this link, and put these prospects into a separate list in your donor CRM. Then, you can send them targeted emails with educational information about QCDs and the tax benefits that go along with them.

If you already have age data and the resources to send targeted outreach emails, make sure to keep them short and simple. You need to:

- Define QCDs and who can give them

- Briefly highlight the tax benefits donors would receive

- Include a link to your QCD donation page

Below, Paul Smith’s College has a great example of a targeted email they sent to their QCD prospects. They outlined the criteria for making QCDs in a few sentences, and linked to their donation page for more information.

Need help implementing these processes and getting more QCDs? FreeWill can help.