Planned giving: A complete guide to planned giving programs

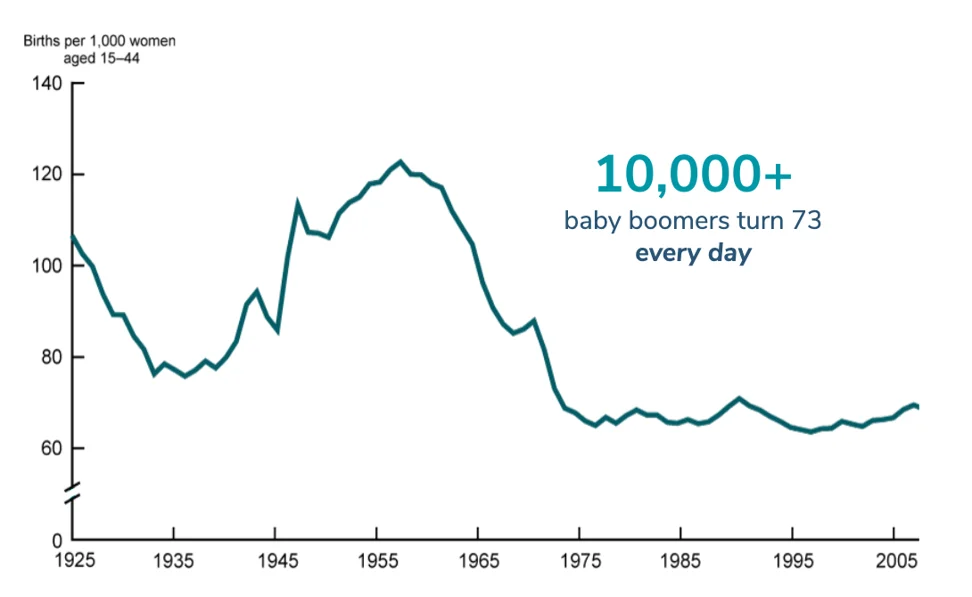

Now, more than ever, nonprofits should invest in planned giving. Over the next 25 years, an estimated $68 trillion will be passed on as the large and wealthy Baby Boomer generation ages. This will be the largest wealth transfer in human history and an unprecedented opportunity for philanthropy.

Furthermore, Americans demonstrated an increased interest in estate planning during and following the Coronavirus pandemic. Here at FreeWill, we saw a 600% increase in bequest giving in March of 2020 as compared to the same time in 2019. This generated nearly $100 million in new planned gifts for nonprofits that month.

If nonprofits can cultivate supporters now and make it easy for donors to include their organization in their wills, they can tap into what may be the biggest moment for planned giving, ever.

In this complete guide, we’ll cover everything you need to know about this form of giving and how to get started creating your own planned giving program.

Planned giving FAQ

What is planned giving?

Planned giving refers to the process of donors committing to give planned gifts to nonprofit organizations. Planned gifts are charitable contributions that are part of a donor’s financial or estate plans and are typically given to nonprofits once the donor passes away. It's also often called legacy giving, although this term typically refers more specifically to estate gifts.

What is the most common type of planned gift?

While there are a few different ways to give via planned giving, bequests are by far the most popular and easiest type of planned gift. Bequests are left in a donor’s trust, will, or estate plan, and are given to a nonprofit upon the donor's passing. Bequests make up roughly 9% of all charitable giving, and the average bequest given by a will-maker on FreeWill is $50,424.

How do nonprofits secure new planned gifts?

Nonprofits create and operate planned giving programs, or legacy programs, to grow their number of planned gifts and support the future of their organizations. The programs are promoted and gifts are facilitated online using dedicated Planned Giving Websites.

Planned giving officers build relationships with prospective and current planned giving donors. Because planned gifts can often take years to materialize and donors may revise their wills over time, it’s essential for organizations to keep in touch with these donors and remind them of the impact of their gifts.

The impact of planned giving for nonprofits

Planned giving has a major impact on how an organization is able to plan for its future and sustain itself in the long run. Here are three key benefits that nonprofits receive from planned giving programs:

1. Planned giving opens up a pool of untapped revenue.

Because planned gifts don’t affect a donor’s everyday cash flow, these types of gifts are accessible to everyone — from those whose incomes rarely permit them to give to major donors who give generous annual gifts. While most planned giving officers focus on cultivating relationships with top donors, research from our founders actually shows that frugal donors who are lifelong savers are often in the best position to give large bequests.

An estimated 2% to 5% of the US population leave bequests in their estate plans. But in our planned giving report, we found that 16% of our users creating free wills chose to create a charitable bequest, well above the national average. We’ve generated over $7 billion in planned gifts for nonprofits, with bequests spanning from $100 to $15 million — representing a pool of planned giving revenue that would have otherwise gone untapped.

2. Planned gifts are large gifts that secure an organization's future.

The average gift size from a will-maker on FreeWill is $50,424. These large gifts bring in a consistent source of funding and support for nonprofit organizations even in times of economic crisis or losses in annual giving.

Additionally, keep in mind that recent changes to the tax code in the United States have made securing these gifts even more essential. With an increase in standard deductions, fewer Americans are able to itemize deductions on their tax returns. In 2018, this resulted in the first year-over-year decrease in charitable giving from individuals in more than five years. By securing planned gifts from a wide range of prospects, nonprofits can recoup these losses.

3. Planned giving increases annual giving.

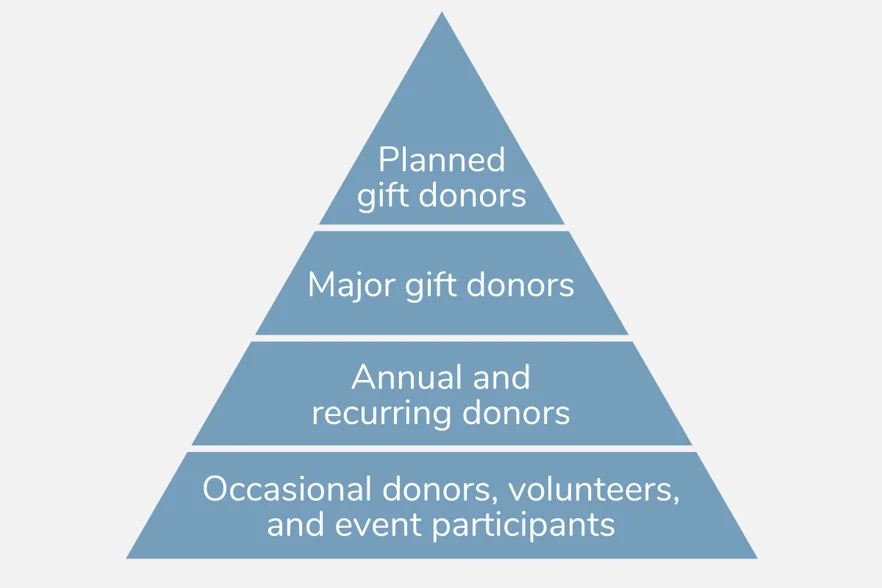

Planned giving is generally thought to be at the top of the traditional donor pyramid — secured after donors have given major gifts.

Planned giving officers are often a part of the major gifts team at their organizations, adopting the tools of that discipline: identifying top prospects, meeting with them in person, and then gradually securing bequest commitments.

However, planned giving can actually invert the donor pyramid by increasing annual giving.

Russell James, a Texas Tech professor and planned giving expert, conducted an in-depth analysis of charitable giving in 2014. He found that donors who left a charitable bequest in their will increased their average annual giving by more than $3,000.

How donors benefit from planned giving

Nonprofit organizations aren’t the only ones that benefit from planned giving — there are several ways that donors can take advantage of these types of gifts as well. Emphasize these benefits when discussing planned giving with your donors:

1. Planned giving allows donors to leave a legacy.

If a donor has been supporting your organization for years, making a bequest in their will is a powerful way to leave a lasting impact. And if they haven’t been able to make a large gift during their lifetimes, they can establish their legacy by making a bequest in their will and supporting their favorite organization for years to come.

2. Donors can decide how their planned gifts are used.

When leaving a bequest in a will to a charitable organization, donors can allocate how or where they want that money to be spent. Because wills are fairly easy to update, donors can also keep their bequests up-to-date by checking in with gift officers on where their donations will make the most impact.

3. Planned gifts can come with tax breaks.

Depending on the type of planned gift a donor makes, there can be some tax benefits for them. Bequests can reduce federal estate taxes for heirs, and these deductions aren’t limited to cash — they can include assets like real estate, IRAs, and stock. Some other types of planned gifts, such as charitable remainder trusts, are granted tax-exempt status by the IRS. However, tax advantages to planned gifts can be a little complicated, so gift officers should make sure to help donors evaluate them on a case-by-case basis.

4 common types of planned gifts

Planned gifts can come in a variety of forms, from simple bequests to complex trusts, all with different requirements and advantages depending on a donor’s circumstances. However, planned gifts most commonly fall within a few categories: outright gifts of cash or non-cash assets, gifts that pay income, and more complex gifts that protect a donor’s assets.

Within these broad categories, there are a few common ways to give:

Bequests

Bequests are a popular and fairly simple way to make a planned gift. These ‘outright’ gifts are charitable contributions left as a bequest in a legal will. They’re usually given as a specific amount, a remainder of a donor’s estate after other bequests have been paid, or a percentage of a donor’s total wealth.

Charitable gift annuities

A charitable gift annuity allows a donor to give a large amount of cash or securities in exchange for a fixed income payment for life. The nonprofit keeps any leftover funds as well as any income generated from investing those funds.

Charitable remainder trusts

There are a few types of charitable remainder trusts, but in each, the remaining funds go to the nonprofit after the trust is terminated. A charitable remainder annuity trust pays the donor a fixed amount based on a percentage of the initial assets used to fund it. A charitable remainder unitrust pays the donor a percentage of its principal and is revalued annually so that payments increase over time.

Charitable lead trusts

When a donor makes this type of gift, the charitable lead trust pays an ‘income’ to the nonprofit for a specified number of years or for the donor’s lifetime. And when that term is up, the assets are given back to the donor or their beneficiaries.

Other gift types that some organizations include in their planned giving programs are non-cash assets, such as stock or real estate, giving from IRAs (also known as Qualified Charitable Distributions or QCDs), and Pooled Income Funds.

See our complete breakdown of the many types of planned gifts to learn more.

How to get started with planned giving

If your nonprofit organization is new to planned giving, there are a few steps you should follow to kick off your efforts successfully.

Step 1: Unify your teams.

Before you start a planned giving program, everyone at your nonprofit should be on board. You have to understand where this program will fit within your organization’s existing infrastructure. Answer these questions:

- Will planned giving belong to the major gifts department? Will it have its own department?

- Will your organization hire an expert or train an existing staff member to source, secure, and steward planned gifts?

- What resources will your organization allocate to increasing or marketing planned gifts?

However your organization decides to approach planned giving, it’s important that your development and communications teams are aligned about marketing planned giving to your supporters. These teams should create shared goals and balance any competing priorities in order to identify key moments to solicit supporters and fundraise for your organization.

At this point, the planned giving team should also work closely with major gifts to identify top prospects for outreach.

Step 2: Equip your organization with tools to track and manage planned gifts.

Team members in charge of running your planned giving program will need the right tools that empower them to succeed. Effective planned gift fundraising and stewardship requires:

- A CRM or database that can track individual engagement and donation data and has moves management capabilities

- Marketing collateral and resources for one-on-one discussions with donors

- A Planned Giving Website to serve as the program's digital home

- Donor-facing estate planning tools and resources to simplify the process of creating planned gifts

If you already have a robust development program in place, your organization is likely familiar with moves management, ongoing donor stewardship, and how to use a CRM for these purposes. Planned giving requires a similar approach but truly exceeds when you can make your asks as easy as possible for donors to complete — FreeWill can help.

FreeWill provides donors with an easy, completely free way to create their own wills and leave bequests to your nonprofit. Estate plans made on our platform are 5 times more likely to include bequests, and these gifts are more than twice as large as the national average. Simply empower your donors to create their free wills, encourage them to create a bequest, and begin securing new planned gifts.

Our tools also support your nonprofit with the data and alerts you need to manage your planned giving program proactively. We’ll even provide your team with customized marketing materials and guidance to ensure your program reaches as many potential donors as possible.

Learn more about our complete set of planned giving tools or explore case studies to see how other organizations have built thriving planned giving programs.

Step 3: Outline your marketing plan.

To consistently secure new planned gifts, your organization will need to create a detailed marketing plan. Just like communicating to your supporters about any other fundraising options or campaigns, repetition and ease are key for marketing planned giving.

As the first step in this process, you should make it incredibly easy for supporters to find and access this new way to give. Add planned giving as a donation option on your website, or create a dedicated landing page or website to explain all the ways a donor can make a planned gift. Give them resources that make it easy to leave a bequest, such as making a will through FreeWill, or offer them support by giving them a person at your organization to contact for more information.

Then, create marketing materials such as emails and direct mail to speak to your donors about the impact and benefits of planned gifts. Identify the best marketing channels for planned giving, and add a few planned giving campaigns and informational events to your organization’s annual communications calendar.

Once your program is set up, your planned giving team should also start meeting with top prospects to help them make a planned gift.

Step 4: Acknowledge your donors.

Planned gifts, and especially bequests left in a will, can be difficult to track. Some organizations occasionally survey their supporters to see if there are any donors who have left bequests and forgotten to notify them. When you do learn about a planned gift, make sure you thank the donor and acknowledge the impact their gift will have on your organization’s mission.

If you’re setting up a legacy society with any special perks, such as public acknowledgments, access to special events, or organizational communications, make sure you invite them to take part. Doing so will help make the donors feel like a part of the community and strengthen their relationship with your organization.

For more tips and a deeper dive into these steps, explore our complete guide to jump-starting your planned giving program.

Planned giving resources and knowledge base

Ready to learn more about planned giving and how to secure planned gifts? Or have more questions about specific topics discussed above? Browse our library of resources for nonprofits full of best practices and examples to help you succeed with planned and major giving.

Here are a few highlights that newcomers to planned giving will find especially helpful:

- 8 types of planned gifts your nonprofit should know

- What are charitable bequests for nonprofits?

- QCDs: What nonprofits need to know about these tax-savvy gifts

- The benefits of planned giving for nonprofits and donors

- Planned giving marketing: 7 strategies and ideas you need

- Make-A-Will Month: 3 effective marketing tips for planned giving

- Amplify your marketing strategy with Planned Giving Websites

Ready to kick start your planned giving program? FreeWill can help. Let’s discuss your nonprofit’s planned giving goals.

How the country's leading nonprofits launched planned giving programs at their organizations.

How the country's leading nonprofits launched planned giving programs at their organizations.